ev tax credit bill date

A new tax credit worth a maximum 4000 for used electric vehicles would be implemented. 849 26 Aug 2022.

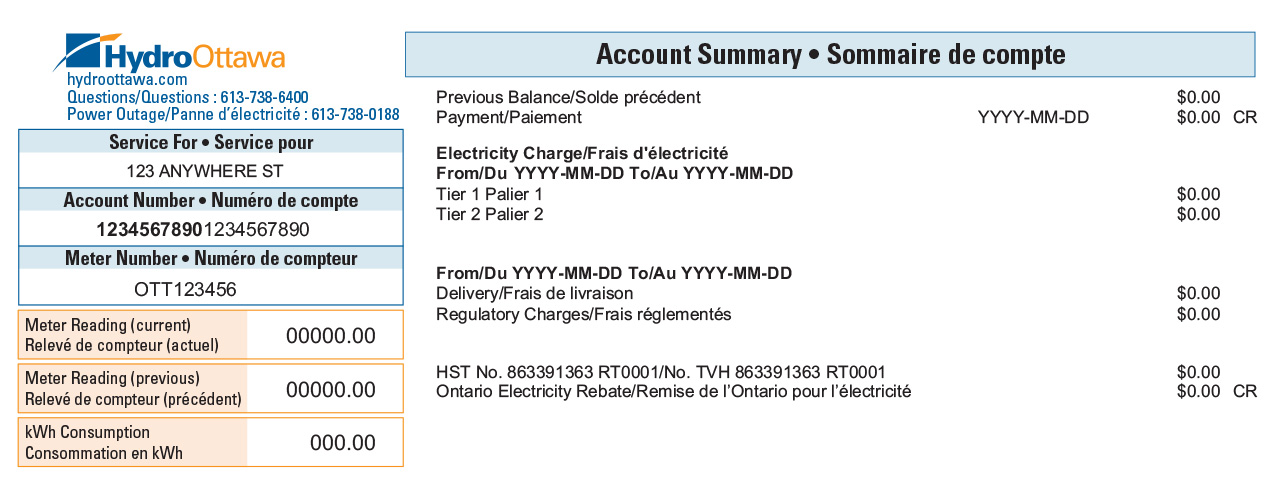

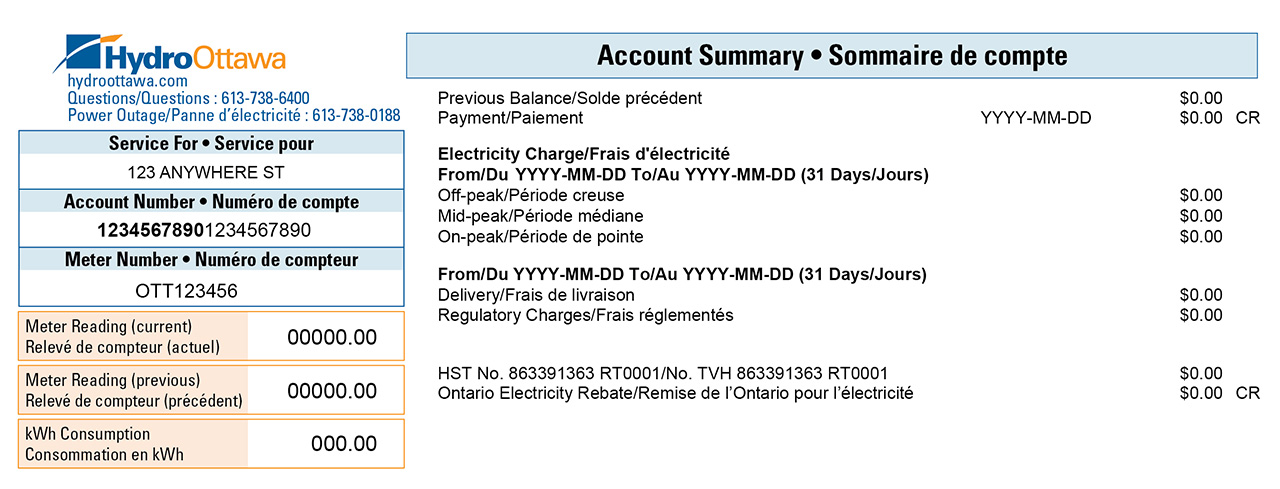

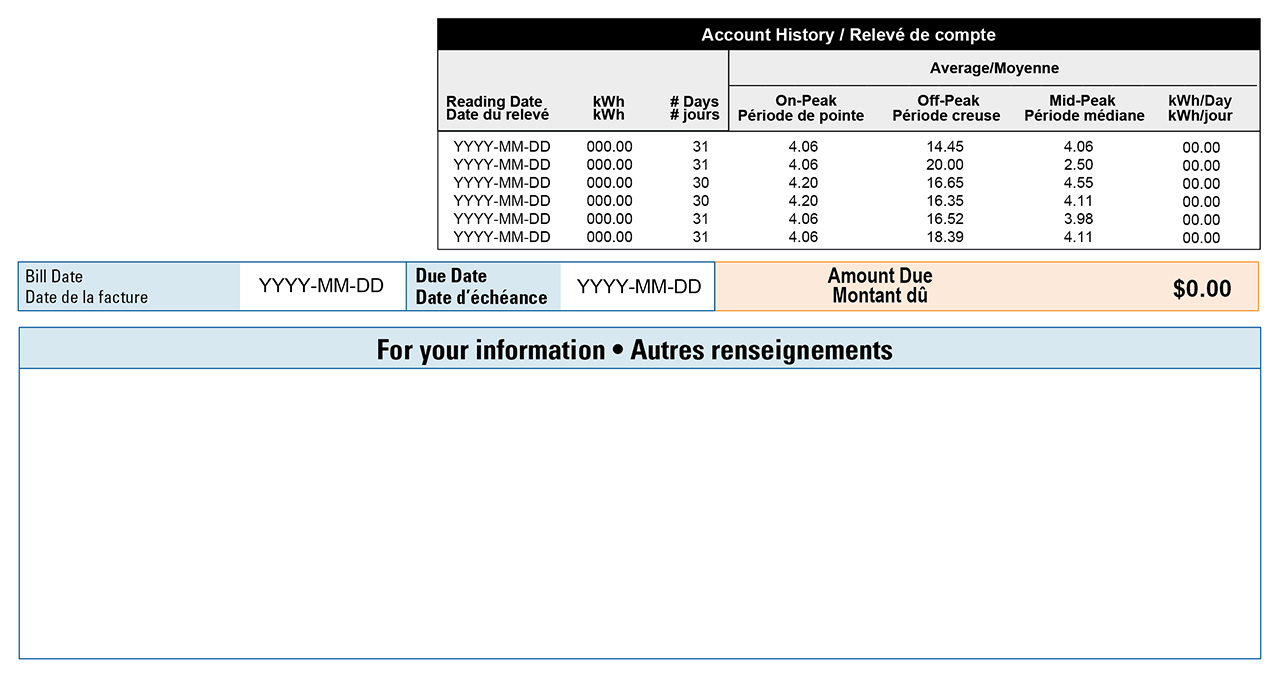

Time Of Use Rates Tou Bill Sample Hydro Ottawa

The main portion of the bill our readers will be interested in is the 7500 electric vehicle tax credit which is renewed starting in January 2023.

. The West Virginia Democrat who previously described federal tax credits for EVs as ludicrous announced a surprise deal with Senate Majority Leader Chuck Schumer on a reconciliation package. Ev Tax Credit Bill. Theres also a provision to allow buyers to take advantage of the EV tax credit upfront at the point of sale but from our reading of the.

Jul 28 2022 at 916am ET. The bill retains the 7500 maximum tax credit but scraps the 200000-unit production limit that GM and Tesla hit long ago and which was about to affect other brands like Toyota and Ford. Ad Ev Tax Credit Bill.

And companies such as Ford Motor and Toyota will soon lose access to the credits. 846 26 Aug 2022. Before this date it remains a tax credit.

Under the bill buyers of previously-owned electric vehicles would be eligible for a 4000 credit or 30 off the cost of the vehicle whichever is. That requirement increases over time reaching 80 percent by 2027. The minimum credit was 2500.

Of those models 70 percent are ineligible for the tax credit when the bill passes. And by 2029 when the additional sourcing requirements go. That tax-credit provision is sparking concerns from climate activists and EV promoters that the much-lauded Senate bill could actually limit the effectiveness of its electric vehicle tax credit by.

For 2023 EV batteries must have at least 40 of battery parts and materials sourced and made in a. Used EVs would now be eligible for a 4000 federal tax credit wit a price cap of 25000. The bill would change the credit from an electric vehicle credit to a clean vehicle credit allowing fuel cell vehicles to qualify.

What the new electric vehicle credits mean for you. The bill imposes an income limit with phase out based on the taxpayers. 1 day agoFull list of key dates for energy bills this winter including price rises and direct payments worth up to 1474.

First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10 yearsuntil December 2032. The exact amount of. Another modification included in the bill.

Other Electric Vehicle Tax Credit Stipulations. The tax credit can be implemented at the point of sale instead of on taxes beginning on January 1 2024. August 10 2022 at 1209 pm.

The bill extends the tax credit for new qualified plug-in electric drive motor vehicles through 2031. Essentially the IRA killed some of the market this year so it could flourish in the futurewith the addition of a 4000 credit on used EVs. 3750 of the credit eligibility is based on battery manufacturing content.

In a nutshell the US Senates potential EV tax credit would remain at 7500 though there would be a smaller credit for people who buy a used EV. In to qualify for the full federal tax credit 40 percent of the metals used in an EVs battery must come from North America. This effectively makes it a rebate.

With the nations most significant climate bill likely to. The phased-out tax credit offered buyers of electric and plug-in hybrid vehicles acquired after December 31 2009 as much as 7500. Its called the Inflation Reduction Act and among a long list of new legislation backed by 374 billion in climate and energy spending it includes an updated 7500 electric vehicle tax credit.

Electric Credit Access Ready at Sale Act of 2021 or the Electric CARS Act of 2021 This bill modifies and extends tax credits for electric cars and alternative motor vehicles.

7 500 Ev Tax Credit Survives New House Tax Bill Carscoops Chevrolet Volt Chevy Bolt Chevrolet

Create A Family Emergency Plan Simply Fresh Designs Family Emergency Plan Emergency Plan Family Emergency

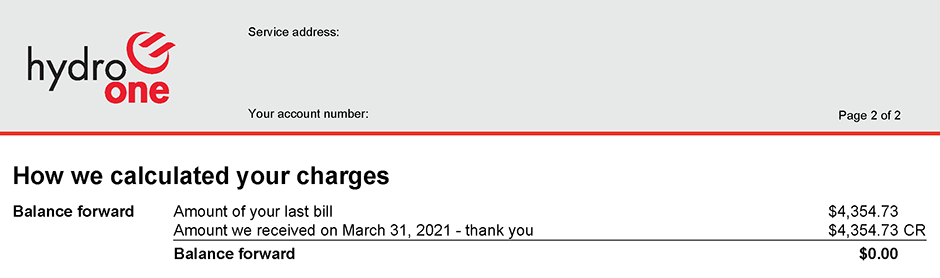

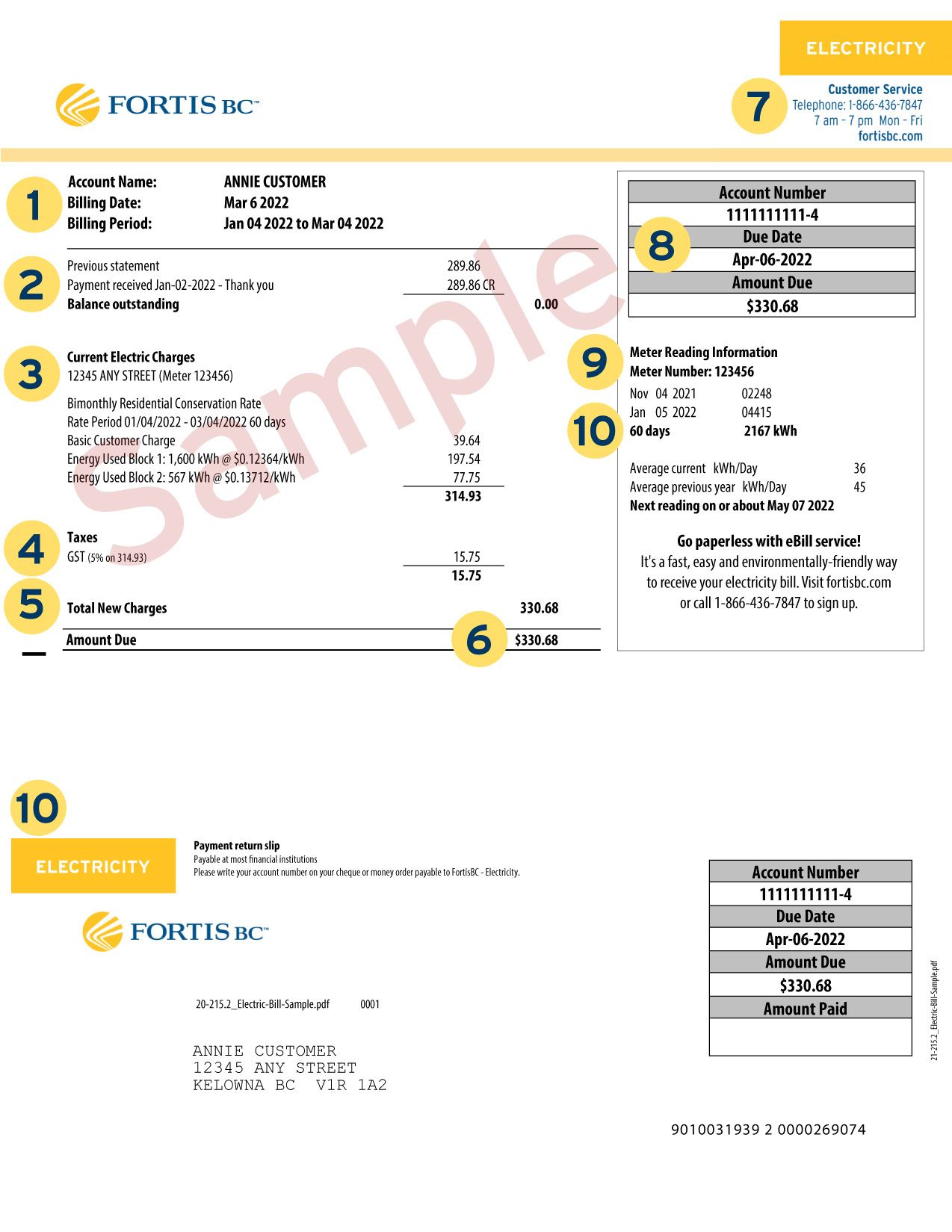

Your Electricity Bill Explained

Time Of Use Rates Tou Bill Sample Hydro Ottawa

![]()

A Few More Finance Printables To Help You Stay On Track Finance Printables Credit Card Tracker Credit Card Payment Tracker

Elon Musk Dodges Question On Tesla Cybertruck Production Talks Model Y Instead Tesla New Tesla Night Time

Tesla Explains How The Full Self Driving Sausage Is Made Self Driving Tesla Tesla Engineering

Ev Tax Credits In Biden S Build Back Better Act Will Help Sell More Cars Than New Chargers In Infrastructure Bill

The Best Options For Hauling Kids And Cargo By Bike A Review From Someone Who Literally Owned Every Option Whether You Need To Adventure Bike Cargo Bike Bike

Pin On Technology Product Design

How To Read Your Electricity Bill