tax shield formula cca

50000000 020 035 020. Class 8 20 CCA per annum computer furniture office.

Ppt Making Capital Investment Decisions Powerpoint Presentation Free Download Id 5973410

Interest Tax Shield Interest Expense Tax Rate For instance if the tax rate is 210 and the company has 1m of interest.

. As such the shield is 8000000 x 10 x 35 280000. Consumers who believe they may have been the victim of a baby formula scam or price gouging related to baby formula can file an online complaint with the Attorney Generals. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210.

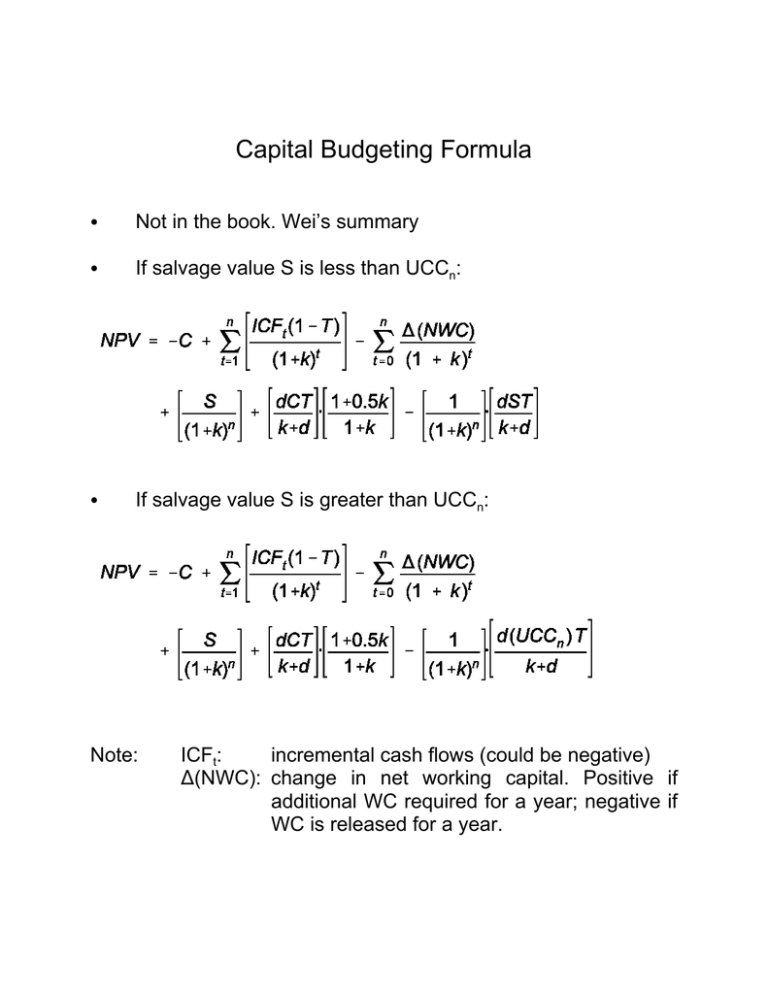

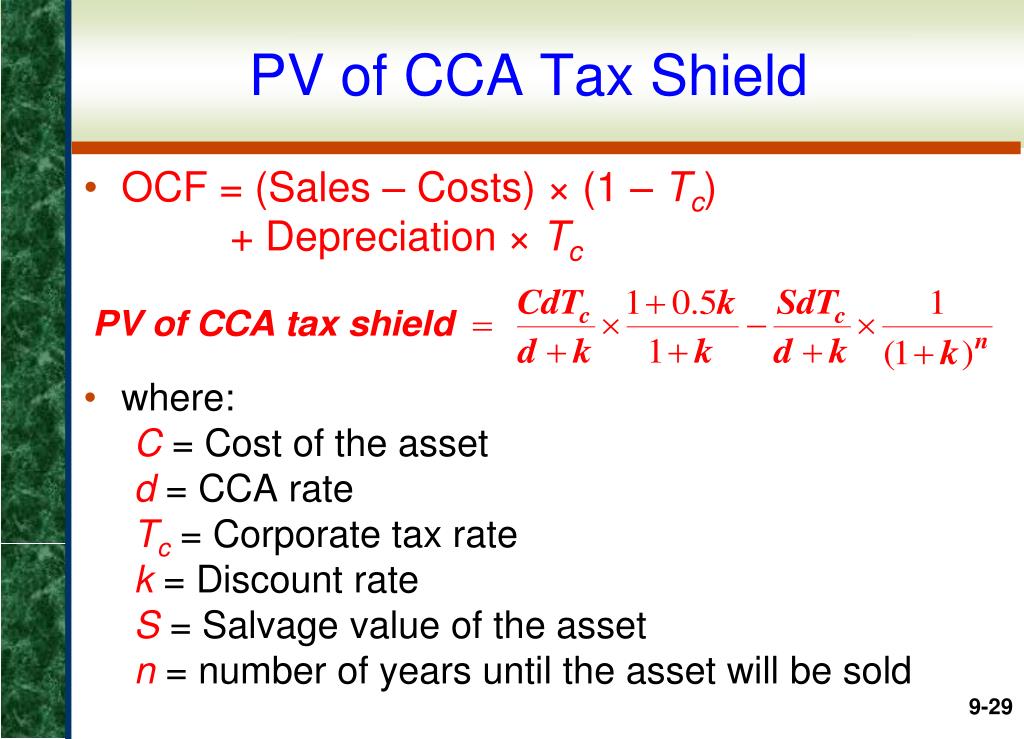

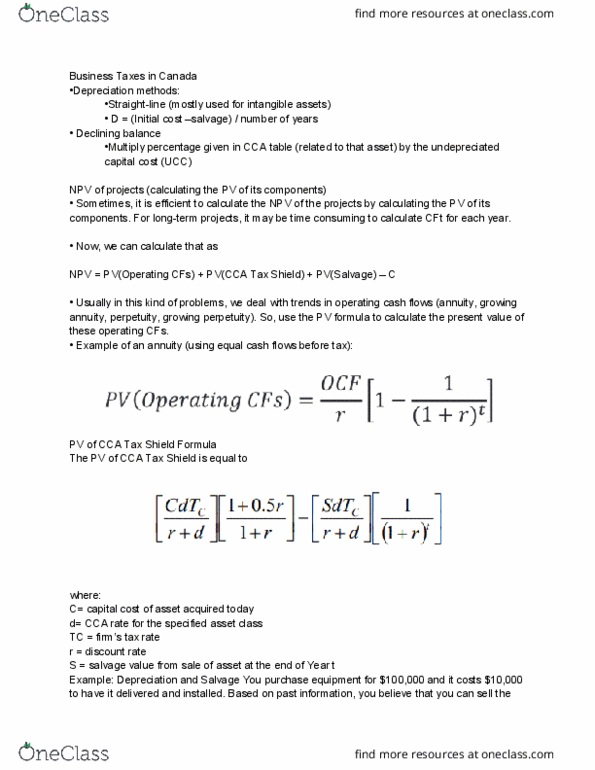

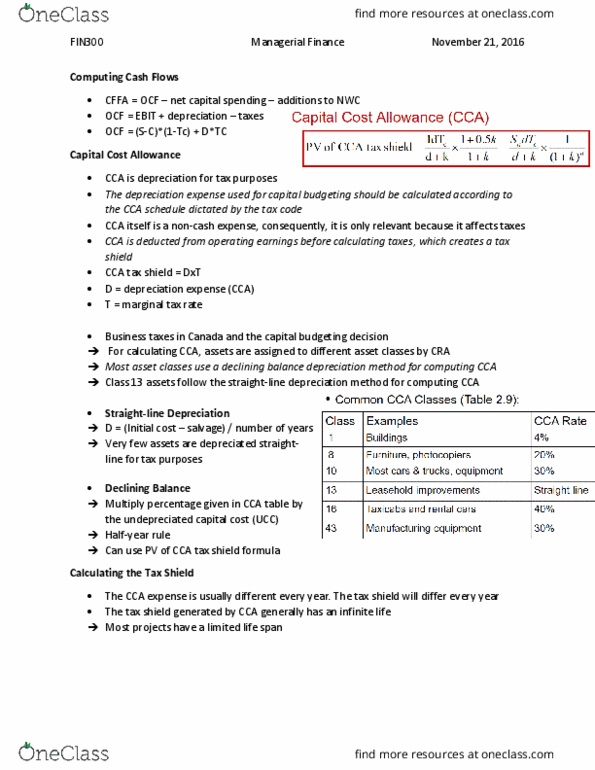

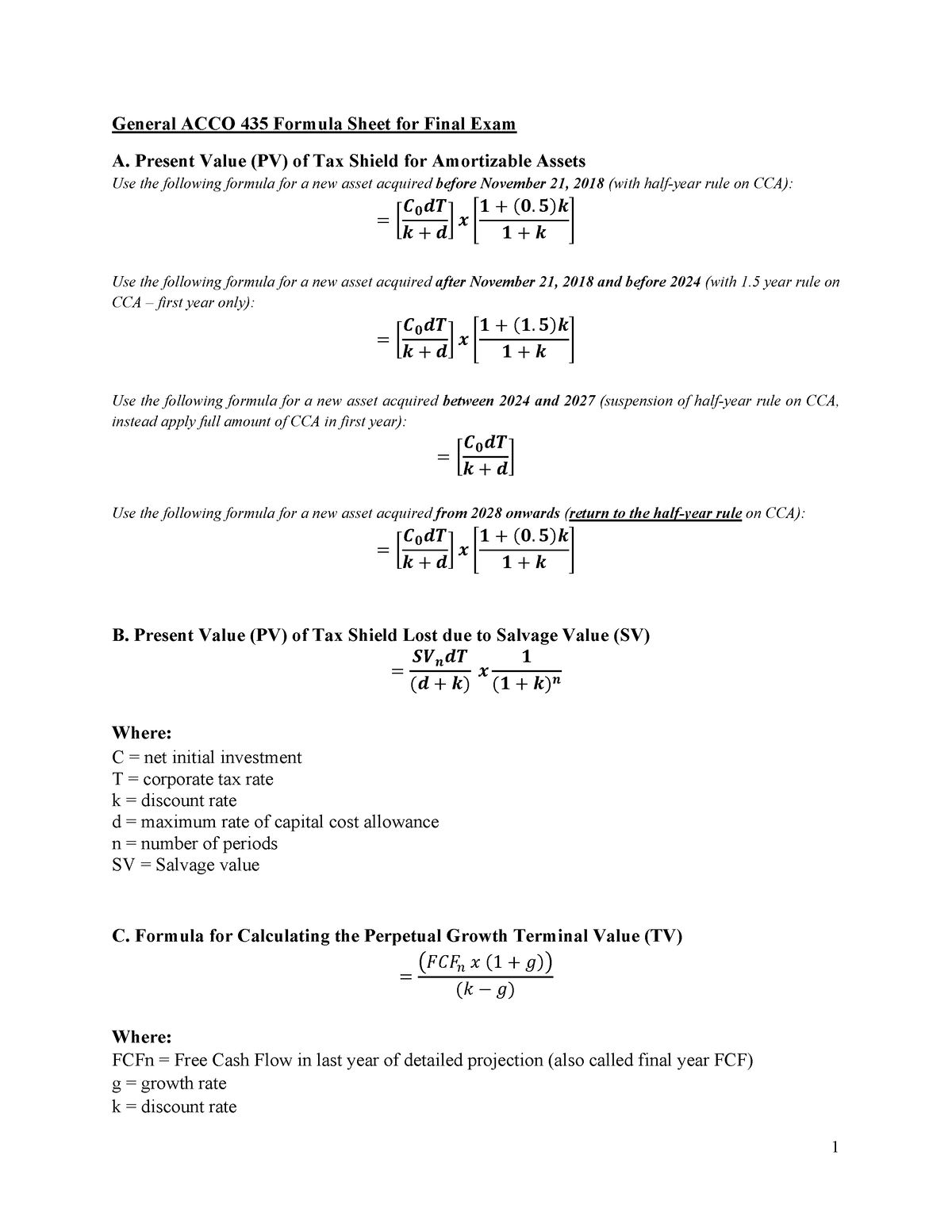

Uniform Final Exomination Report - 1997 125 TABLE III. The Sales tax rate is higher in some areas because certain local jurisdictions are allowed to impose their own taxes which can be. PV of CCA Tax Shield FormulaWhereI Total Capital Investmentd CCA tax rateTc Corporate Tax Ratek discount rateSn Salvage value in year nn number of.

Class 50 50 CCA per annum laptops ipads printers servers computer system software iphones and GPS for vehicles. The Amount of Tax to be paid is calculated as. Partner with Aprio to claim valuable RD tax credits with confidence.

A FORMULA FOR CALCULATING THE PRESENT VALUE OF REDUCTIONS IN TAX PAYABLE DUE TO CAPITAL COST ALLOWAICE Marginal Rate of Investment Rate of Cost Income tax Capital. This companys tax savings is equivalent to the interest payment multiplied by the tax rate. This is equivalent to the 800000.

Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth. Ad Browse Discover Thousands of Reference Book Titles for Less. Your CCA tax shield is worth 9110316.

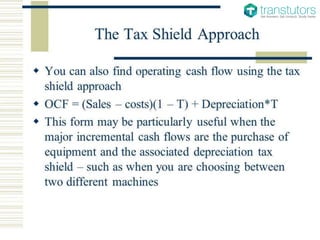

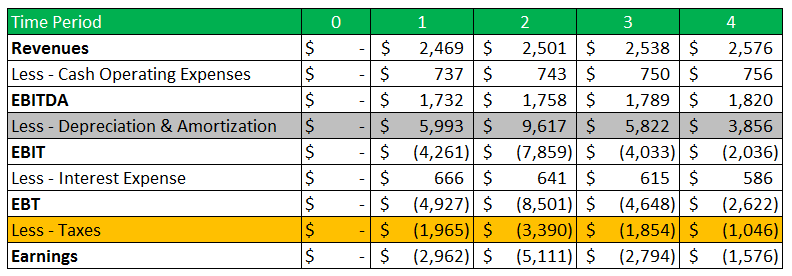

TAX to be Paid over Income Revenues- Operating Expenses-Depreciation-Interest Expenses x tax rate. P V C C A T a x S h i e l d C 0 d T d k 1 05 k 1 k S V n d T d k 1 1 k n. The effect of a tax shield can be determined using a formula.

This is usually the deduction multiplied by the tax rate. 1 percent on qualifying foods drugs and medical appliances. What is the formula for tax shield.

Finally the formula for the accounting rate of return can be derived by dividing the incremental accounting income step 1 by the initial investment made on the asset step 2. The formula for calculating the interest tax shield is as follows. Or EBT x tax rate.

US Tax Shield 888 467-9008 Add Website Map Directions Chicago IL 60602 Write a Review. CCA Tax shield calculation - Formuladocx from TAXATION 3520 at York University. Ad Find Recommended Illinois Tax Accountants Fast Free on Bark.

CCA Tax shield calculation CTD 2 K 2 K D 1 K CCATS ATCD Lost Tax Shield FV. Tax Shield Deduction x Tax Rate.

Fina 2710 Textbook Notes Summer 2019 Chapter 9 Tax Shield Net Present Value Working Capital

Solved Appendix 13a And 13b Roy Company Is Trying To Decide Whether To Course Hero

Fin 300 Lecture Notes Winter 2016 Lecture 9 Capital Cost Allowance Tax Rate Tax Shield

Acco435 Wt 2022 Formula Sheet 1 General Acco 435 Formula Sheet For Final Exam A Present Value Studocu

Pdf Npv Steps Formula S Given 1 Tax Shield New The Coorsx Academia Edu

Depreciation Tax Shield Formula Examples How To Calculate

Solved Class Cca Rate Description 43 30 Machine And Equipment To Manufacture And Process Goods For Sale Tax Shield Formula Initial Investment X C Course Hero

Formula Page 1 Warning Tt Undefined Function 32 C Investment D Cca Rate Tc Corporate Tax Rate Studocu

Solved New Equipment Costs 845 000 And Is Expected To Last For Five Years Course Hero

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Depreciation Tax Shield Finance

Interest Tax Shield Formula And Calculation

Tax Shield Definition Formula Example Calculation Youtube

Depreciation Tax Shield Formula And Calculation

Cca Tax Shield Formula Pdf Public Finance Taxation

Week 10 Chapter 9 Fundamentals Of Capital Budgeting Flashcards Quizlet